Calculate your mortgage rates

First of all, you must know your mortgage rates. Mortgage rates are the interest rate you pay for buying or selling a house, and they fluctuate based on national economic conditions. You should always calculate what your mortgage will be before buying or selling property so that you know how much money to save up in advance.

How do you calculate my mortgage payment? To calculate your mortgage payment, you need to know the following:

-

monthly principal and interest balance

-

length of time it will take for the loan to be repaid

-

annual percentage rate (APR) on the note.

You have to be aware of your full financial status so get to work. You can calculate this information by using a calculator like this one where you’ll learn everything you need. For buying a house, you have to know this information before buying the home. For selling your property, it’s important for them to buy them if they don’t know these things about their mortgage and may make a mistake without realizing it.

If buying a home, you need to know your monthly principal and interest balance. This will help you calculate the amount of money that is left for the down payment. To know this, you need to calculate the total mortgage and then subtract your down payment. If selling a house, you have to be aware of how long it will take for the loan to be repaid. You can find out by dividing the monthly principal and interest balance into the number of years on your note. The lower that number is in months, the higher your mortgage rates will be.

If buying a home, you need to know what the annual percentage rate is on your note. This helps you avoid getting into financial trouble with high monthly payments and interest rates that are too expensive for you. To figure out this information, divide the APR by 12 to get an idea of how much money you’ll be paying every month.

You want to know how much you’re buying or selling the home for, but it’s also important to find out what your mortgage rates are so that you can accurately calculate your monthly payment and plan accordingly. This will help you avoid any financial troubles down the road!

Make sure your house is well maintained and has no major defects or problems that could turn off potential buyers

House maintenance is an important part of house buying and house selling. This is the surest way to make your house stand out from its competition, not just by looking good but also by making it more marketable, as well as reducing the chance that you’ll need expensive repairs down the line. Given how much money a prospective homebuyer has in their budget for maintenance and repairs (which can range anywhere from zero up to tens of thousands), this could be an easy sell when speaking with buyers.

If you’re house shopping, it’s important to look for houses that have been well maintained. If the house has a new roof or other large repairs in recent history, this could be an indication of house maintenance on behalf of the homeowner and will likely mean fewer surprises down the road. And if you’re selling your house, make sure any open issues are taken care of before putting up signs; prospective buyers may not notice them during an inspection but they’ll see them right away when viewing online photos!

There are many ways to maintain your house so that it stays healthy and attractive (and thus more marketable!) over time like investing in regular inspections by a qualified home inspector or creating a house maintenance checklist.

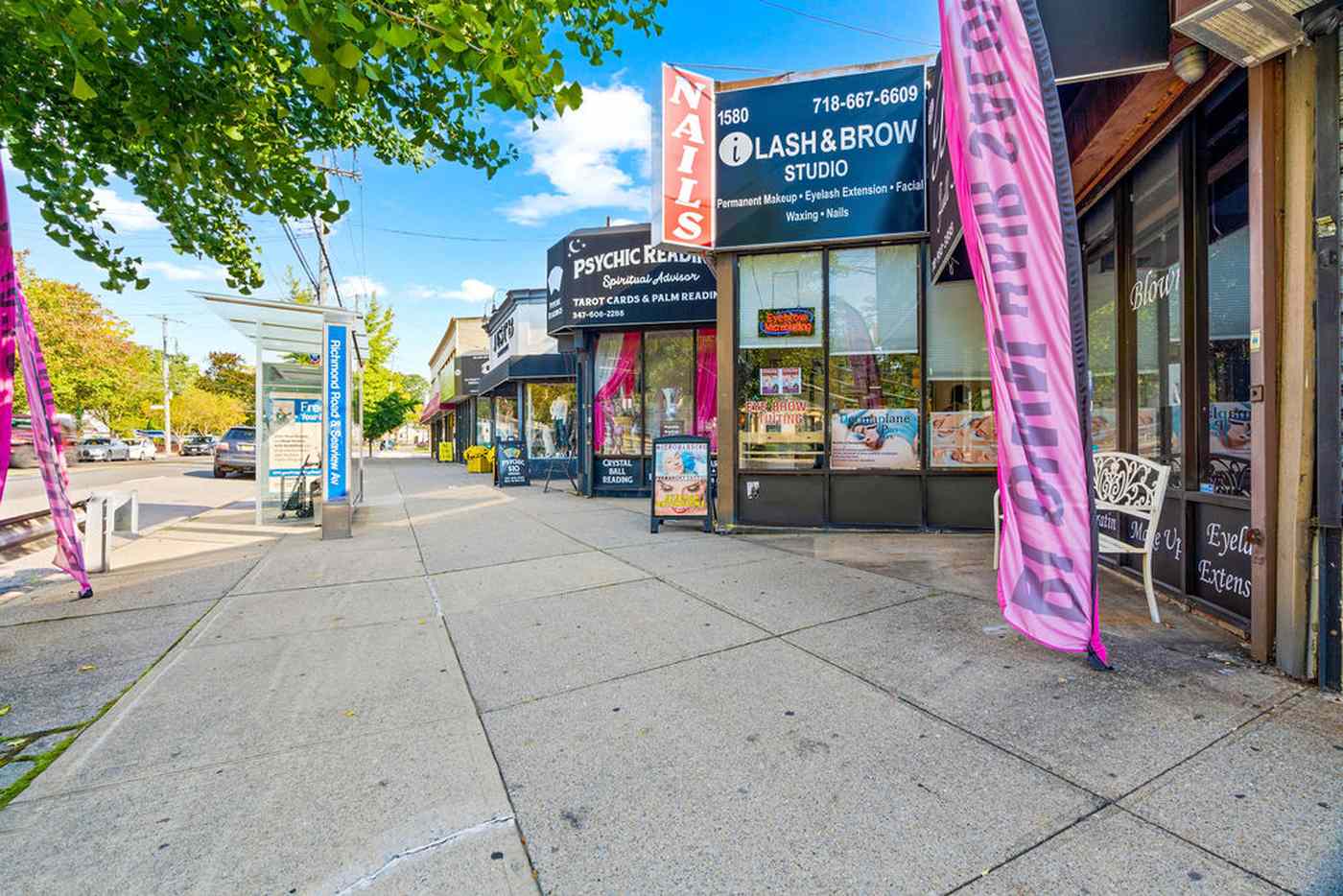

Be mindful of the condition of the neighborhood where you’re buying or selling

Checking out the neighborhood is an important step when considering the purchase of a house. Not only is it where you’ll be spending most of your time, but it will also reflect on the property value and resale potential

The condition of the neighborhood affects how desirable or expensive houses are in that area. This includes things such as walkability, public transit accessibility, crime rates to name a few. If you’re buying a house then this factor can affect whether or not someone might want to buy from you later down the line.

If you’re selling a house, make sure that pictures were taken showing how good (or bad) the neighborhood looks at different times so buyers know what they could potentially get into. Not every house will fit every person’s needs. A house has to be in the right area to make you happy.

If house hunting is a question of whether or not it will fit your needs, then location becomes an important factor when deciding on which house to choose. It’s where you’ll spend most of your time and also reflects on how much value and resale potential a house may have in that area.

Get a home inspection, even if the seller offers one

You must do your homework thoroughly to make sure you are buying a house that is right for you. This includes getting an inspection before closing the deal, even if it’s offered by the seller or their agent. You can’t be too careful when investing in such a large purchase as this and don’t want to end up with regrets later on because of your laziness or limited information.

Hiring someone who will do things like check insulation levels, plumbing fixtures, electrical wiring and more will uncover any potential problems which could cost much more than hiring them initially! This service not only ensures you know what condition the house is in but also helps determine how far along renovations have been done already so there won’t be surprises after purchasing a house.

Hopefully, these hacks will be helpful to you, and that it’s given you some great tips for buying or selling a home. Remember, the more information you have before making your decision on whether to buy or sell, the better off you’ll be! Always look into affordability with a mortgage calculator. Good luck!

Leave a Comment